Why Understanding Inflation Matters Now

In 2024-2025, the global economy continues to face persistent inflationary pressures. From the rising cost of your morning coffee to increasing rental prices, and even to the volatility in your investment portfolio, inflation’s impact is omnipresent. Understanding the nature and types of inflation not only helps protect your personal assets but also enables you to discover potential investment opportunities.

To keep you closely aligned with market dynamics, this article incorporates inflation trend examples from recent years (2022-2024) and differences between various economies. It also provides specific investment portfolio allocation references to help you better plan your finances and manage investment risks in this inflationary era.

Key Insights

- Inflation is not a singular phenomenon but a complex economic state – ranging from mild inflation (beneficial to the economy) to hyperinflation (economic disaster). Investment strategies must be flexibly adjusted according to the current type and stage of inflation.

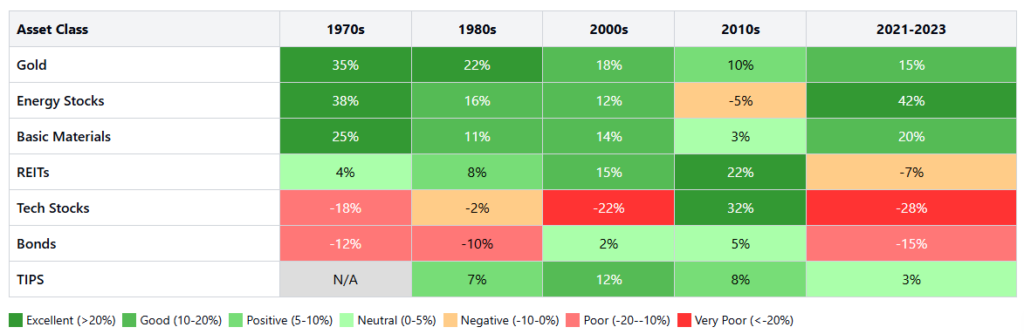

- Historical data clearly demonstrates significant differences in asset classes’ resistance to inflation – gold and energy stocks have excelled during most inflationary periods, while technology stocks and fixed-income assets often underperform, proving the importance of diversified asset allocation in combating inflation.

- The most effective anti-inflation strategy is an integrated multi-pronged approach – including investments in real assets (such as REITs and commodities), selection of quality stocks with pricing power, actively enhancing personal income potential, and strategic use of low fixed-rate debt, rather than relying on a single strategy.

I. What is Inflation? Types and Causes Explained

Definition and Actual Impact of Inflation

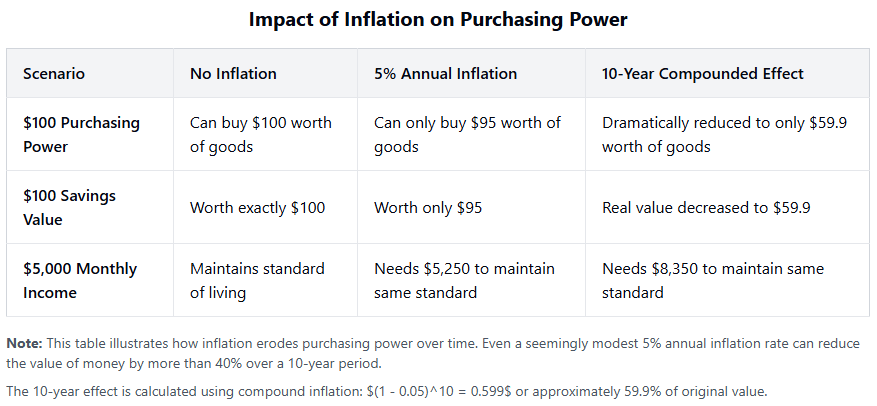

Inflation is an economic phenomenon where price levels rise broadly and continuously while the purchasing power of money declines. This is not just an economic term but a reality that directly affects our daily lives.

To illustrate: If this year’s Consumer Price Index (CPI) is 150 and last year’s was 100, the inflation rate is 50%. This means the same goods that cost $100 last year now cost $150, representing a 33% decrease in purchasing power.

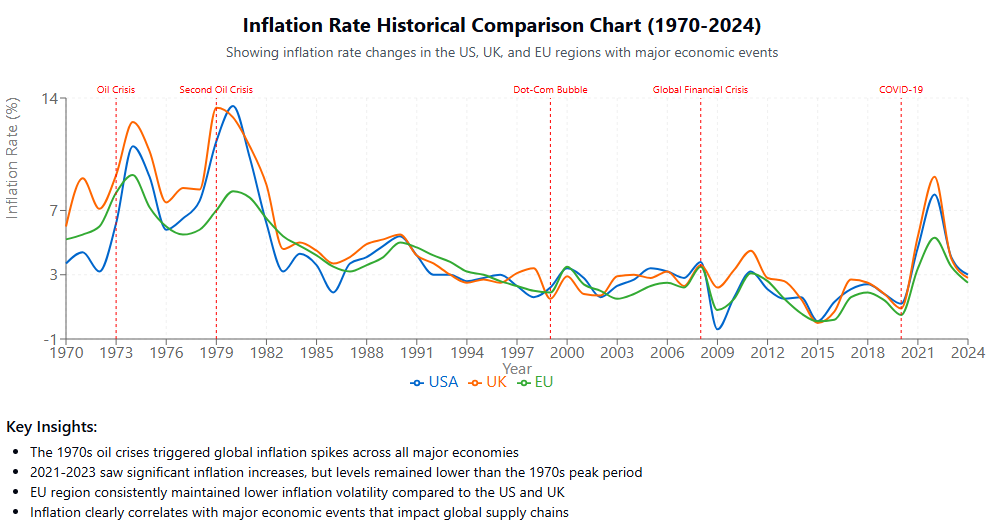

Now that we understand the basic concepts and causes of inflation, let’s examine how inflation has affected the global economy from a historical perspective. The following graph shows the changes in inflation rates in different regions from 1970 to the present, as well as how major economic events have impacted inflation:

The above chart shows that inflation is not a static phenomenon but a dynamic process influenced by global economic events and policies. Next, let’s delve into the main types of inflation.

Four Major Causes of Inflation with Real Examples

Understanding these four main driving forces behind inflation helps us better predict and respond to inflation trends:

1. Demand-Pull Inflation

Definition: Price increases caused by market demand exceeding supply capacity, with too much money chasing too few goods.

Typical Case: In the post-pandemic period, massive government fiscal stimulus combined with pent-up consumer demand pushed U.S. inflation to a 40-year high of 9.1% in 2022.

Identifying Features: Increased consumer spending, higher employment rates, rising wages, robust economic activity

2. Cost-Push Inflation

Definition: Price increases driven by rising production costs rather than increased market demand.

Typical Case: The Russia-Ukraine conflict in 2022 caused global energy prices to soar, with European natural gas prices rising over 200%, triggering widespread cost-push inflation.

Identifying Features: Rising raw material prices, supply chain disruptions, increased transportation costs, higher labor costs

3. Imported Inflation

Definition: Price increases due to higher import costs or domestic currency depreciation.

Typical Case: In 2023, the Turkish lira depreciated by over 50%, causing imported goods prices to surge and pushing inflation rates above 80%.

Identifying Features: Domestic currency depreciation, high import dependency, expanding trade deficits, rising international commodity prices

4. Expectation-Driven Inflation

Definition: Self-fulfilling inflation caused by people’s expectations of future price increases, leading to advance purchasing or hoarding.

Typical Case: During the early stages of the pandemic in 2020, many countries experienced panic buying of toilet paper, disinfectants, and other necessities, causing short-term price spikes.

Identifying Features: Increased consumer hoarding behavior, preemptive price increases by businesses, wage negotiations incorporating future inflation compensation

II. The Three Types of Inflation

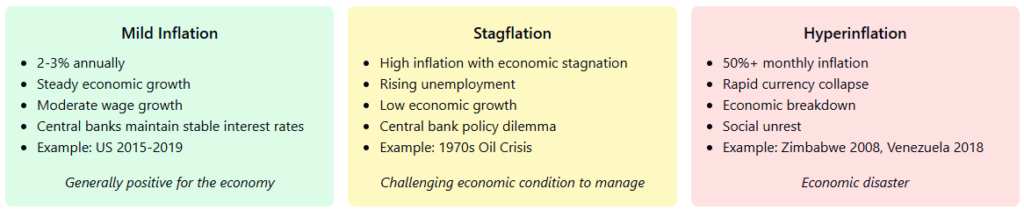

Inflation is not an unchanging phenomenon. Based on its severity and economic impact, we can classify inflation into three main types. Identifying which inflationary environment we are currently in is crucial for developing correct investment and financial strategies:

- Mild Inflation: Annual inflation rate of approximately 2-3%, representing a relatively healthy economy. The United States was in this state between 2015 and 2019.

- Stagflation: Simultaneous rise in inflation and unemployment rates. The oil crisis of the 1970s is a typical example.

- Hyperinflation: Monthly inflation rate exceeding 50%, with rapid currency collapse, as seen in Zimbabwe in 2008 and Venezuela in 2018.

III. Measures of Inflation

To effectively measure inflation levels, economists have developed various indicators, with the most commonly used being:

Consumer Price Index (CPI)

- Definition: Measures changes in price levels of consumer goods and services purchased by households

- Calculation Method: Weighted average of price changes for various goods and services

- U.S. Composition: Covers eight major categories, including food and beverages, housing, apparel, transportation, etc.

- UK Composition: Similar structure but with different weightings reflecting British consumption patterns

Core Consumer Price Index (Core CPI)

- Definition: CPI excluding volatile food and energy items

- Purpose: Eliminates seasonal factors to more accurately reflect long-term inflation trends

- Importance: Central banks focus more on Core CPI when formulating monetary policy, as it reflects long-term inflation trends. If Core CPI also rises significantly, it indicates inflation is spreading to most industries.

Calculating the Inflation Rate

The formula for calculating the inflation rate:

Inflation Rate (%) = (This Year’s CPI – Last Year’s CPI) / Last Year’s CPI × 100

IV. The Economic Impact of Inflation

A. Impact on Individuals

- Rising Cost of Living: Rent and food prices are first to be affected, increasing the real burden on those with fixed incomes.

- Moderate Inflation (2-3%) can drive wage growth; if exceeding 5%, purchasing power will be significantly eroded.

B. Impact on Businesses

- Rising Production Costs: Increases in raw materials and energy prices squeeze profit margins.

- Pricing Power: Market leaders can pass inflation costs to consumers, while small and medium-sized enterprises face greater competitive vulnerability.

C. Stock Market Impact

- Inflation-Resistant Industries: Consumer staples, energy, and utilities are relatively defensive. Energy stocks surged in 2022 due to soaring oil prices.

- Growth-Oriented Tech Stocks: Valuations come under pressure in high-inflation, rising interest rate environments.

D. Bond Market Impact

- Fixed Income Devaluation: Inflation erodes interest income, reducing real returns.

- Rising Interest Rates Impact Bond Prices: Only TIPS (Treasury Inflation-Protected Securities) and floating-rate bonds offer defensive properties.

E. Impact on Real Assets

- Real Estate, Metals, Agricultural Products: Often positively correlated with inflation. Real estate in many countries rose in 2022 due to inflation expectations.

- Gold and Precious Metals: Safe-haven assets during geopolitical turmoil, also effective against currency devaluation.

V. Complete Guide to Ten Anti-Inflation Assets

In a global inflationary environment, selecting the right asset allocation is key to protecting and growing your wealth. But which assets perform best in inflationary environments? The following heat map shows the real rate of return for seven major asset classes during the past five high-inflation periods:

1. The Overall Stock Market

- Why It Resists Inflation: Quality companies can pass costs on to consumers.

- Sector Differences: Energy, basic materials, consumer staples, and utilities perform better; high-valuation tech stocks tend to underperform.

- Investment Recommendations:

- 🔵 Beginner Strategy: Invest in S&P 500 or global stock index ETFs (such as VOO, VT)

- 🟠 Intermediate Strategy: Increase allocation to energy and utilities sectors

- 🟣 Expert Strategy: Select individual stocks with strong economic moats and pricing power

2. Companies with Strong Pricing Power

- Key Indicators: High brand loyalty, high gross margins, ability to pass on inflation.

- Case Studies: Apple maintained stable profit margins despite increasing iPhone prices by 12% in 2022-2023; Coca-Cola successfully passed on raw material costs.

- Investment Approach: Focus on companies with demonstrated ability to maintain margins during inflationary periods.

3. Real Estate / REITs

- Inflation-Resistant Mechanism: Rents can adjust with inflation; rising construction costs make existing properties more valuable.

- Recommendations: Focus on equity REITs (residential, logistics, self-storage), avoid mortgage REITs with excessive interest rate risk.

- Historical Performance: During periods of high inflation (>4%), equity REITs have provided an average real return of 7.2%.

4. Commodities

- Why They Resist Inflation: Inflation often originates from rising commodity prices.

- Investment Channels: Commodity futures ETFs, mining and energy company stocks; high volatility suggests combining with other assets.

- Focus Areas for 2025: Copper, lithium, nickel, and rare earth metals needed for green energy transition face supply gaps.

5. Precious Metals (Gold, Silver)

- Mechanism: Possess scarcity, historical store of value function, and attract capital inflows during geopolitical tensions.

- Investment Methods: Physical metals, ETFs, mining stocks; choose based on risk preference.

- Performance Data: During high inflation years, gold has averaged annual returns of 15.2% above inflation.

6. Inflation-Protected Bonds (TIPS)

- Principal and interest adjust with CPI, effectively countering inflation erosion.

- Suitable for conservative investors or those looking to reduce volatility, TIPS ETFs (such as TIP, STIP) offer easy access.

- “Phantom Income Tax” Issue: In the U.S., TIPS principal adjustments are taxed as current income, even though investors only receive this increase at maturity.

7. Floating-Rate Bonds

- Adjust with market interest rates, interest income grows when rates rise.

- Examples: FLOT, FLRN, bank loan ETFs; credit risk should be monitored.

- 2025 Considerations: In the global environment of inflation above target levels with central banks potentially beginning rate cut cycles, floating-rate instruments are in a special period.

8. Energy and Basic Materials Stocks

- During inflation, energy companies and miners experience expanding profit margins as commodity prices rise while fixed costs remain relatively stable.

- Investment Recommendations: Focus on low-cost producers with strong free cash flow; also consider green transition trends.

- Sector Performance: Energy stocks provided 14.7% real returns during the 2021-2023 inflation period.

9. Consumer Staples Stocks

- Inflation-Resistant Mechanism: Staples have inelastic demand, allowing companies to gradually raise prices to maintain profits.

- Much more defensive than consumer discretionary products (luxury goods, leisure travel) during high inflation.

- Case Studies: Companies like Procter & Gamble, Coca-Cola, and Nestlé maintained stable margins during the 2021-2022 inflation spike.

10. Strategic Use of Debt Leverage

- Inflation benefits fixed-rate long-term debtors (borrowers) as the real interest rate becomes negative.

- Recommendations: Lock in low-rate mortgages, use fixed-rate corporate financing, avoid floating rates and excessive leverage.

- Economic Principle: “Inflation tends to transfer purchasing power from savers to borrowers.”

Conclusion: Financial Wisdom in the Age of Inflation

Inflation presents both challenges and opportunities. In this era of living with inflation, understanding its nature, impact, and response strategies is an essential capability for every investor and household. By establishing a diversified portfolio based on your circumstances and combining it with comprehensive income, expense, debt, and mindset management, you can not only protect your assets amid inflationary currents but also seize growth opportunities to achieve steady wealth accumulation.

Five Core Mindsets:

- Inflation is an Economic Norm: Moderate inflation has positive effects on the economy; only excessive inflation is destructive.

- Cash Silently Shrinks: If investment returns are below inflation rates, real wealth continuously drains away.

- Dynamic Adaptation Trumps Precise Prediction: Multiple asset allocations and regular adjustments outperform “guessing tops and bottoms.”

- Diversification + Pricing Power Companies: Simultaneously focus on macroeconomic cycles and individual companies’ inflation resistance.

- Mindset and Action Go Hand in Hand: Stay calm amid market noise, embrace a long-term perspective, integrate financial strategies with lifestyle.

Inflation should not be viewed as a devastating flood but as an economic force that can be navigated. Through the tools and strategies presented in this article, we hope to help you maintain healthy wealth growth during inflationary times, or even breakthrough constraints to achieve greater financial freedom. Happy investing and may your wealth multiply!

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Investing involves risks, including the potential loss of principal. Past performance does not guarantee future results. Consult with a professional financial advisor before making any investment decisions.